The manuscript is of an empirical nature.

The current ecological crisis requires boards of directors to tackle environmental concerns and manage dependencies with the external environment in highly dynamic conditions. Proactive environmental strategies (PESs) seek to establish alternative and innovative processes and products that create new market opportunities. By mobilizing the notion of board demographic faultlines, we investigate their link with PESs and the influence of the internal board dynamics and environmental factors on this relationship.

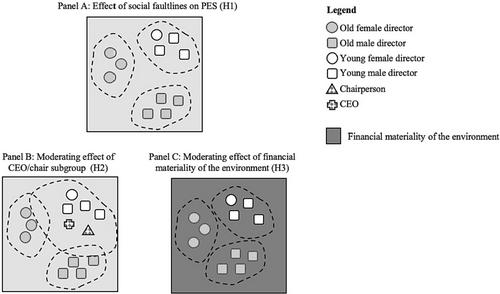

The multilevel regression analysis of a 7-year sample of UK boards reveals that demographic faultlines hinder their information processing in adopting PESs. The results also show that the negative relationship between demographic faultlines and PESs is attenuated by the social similarity of the CEO and chair in the same subgroup and by the financial materiality of the natural environment.

This study draws on faultline theory to analyze how the structure of board diversity through the alignment of multiple directors' demographic attributes affects board dynamics by creating polarized boards that shape sustainability decisions. This study underscores the disruptive effect of having socially distanced subgroups within the board and the salience of board leaders' social similarity and environmental factors in attenuating their dysfunctional effects.

Board diversity is considered key to improving board decision-making. By situating our empirical investigation in a country with a corporate governance model that fosters diversity in a dual leadership board structure that has influenced other countries' governance models, this study provides insights for policymakers and market participants on the unintended effects of the global call for board diversity on firms' proactive environmental stance. Our results call for establishing procedures to incentivize board socialization and facilitate directors' information processing.