This study explores the relationship between the presence of a lead independent director (LID) and firms' internal information environment. LIDs are elected independent members of the board who perform key duties for the independent directors and the board, including reviewing and approving board meeting agendas, chairing non-executive board meetings, and acting as a liaison between the CEO and other independent directors. We hypothesize that LID presence lowers information barriers between the CEO and the rest of the board members, enabling more rapid information acquisition and integration and enhancing the internal information environment of the firm.

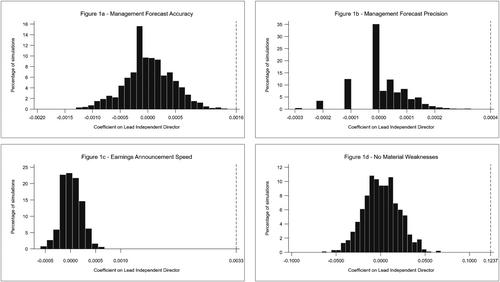

Using a sample of US publicly listed companies from 2001 to 2019, we document that LID presence on the board is positively associated with proxies of internal information quality that reflect better information acquisition and information integration: accuracy and precision of management earnings forecasts, speed of earnings announcement, and absence of material weaknesses in internal controls. These results are robust to alternative model specifications, including entropy balancing, Heckman two-step correction for self-selection bias, firm fixed effects, and placebo tests. Further analyses suggest that LIDs with financial expertise and audit committee memberships are more effective in positively influencing internal information quality. We also show that LID presence is positively associated with several proxies of external information quality.

We build on agency theory to argue that LIDs improve internal information quality by reinforcing the information quality benefits of unified leadership while mitigating potential compromises in information quality arising from entrenchment. Similarly, we use arguments emanating from the novel strategic leadership systems theory to posit that a LID appointment facilitates the tasks of the CEO and the board, enhancing the effectiveness of both groups in their respective roles: the CEO in making operating and investment decisions and the board in strengthening oversight while bringing cohesion in their shared role of strategy visioning and implementation.

Our findings suggest that there is scope for shareholders to consider LID appointments as an addition to their firms' corporate governance structures to enhance the internal information environment and decision-making efficiency. Policymakers can also encourage LID appointments on the board when promoting best practices in corporate governance through regulatory guidelines.