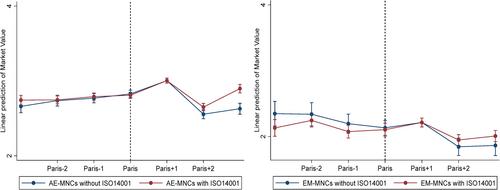

Despite the prominence of International Organization for Standardization (ISO) 14001 certification as a global strategy instrument, there is persistent doubt about its effectiveness as a value-generating tool, especially for multinational corporations (MNCs). This study draws on institutional theory to explain the varying market valuations of international environmental management certification following a strongly binding multilateral environmental agreement. We submit that ISO 14001 certification increases the market value of MNCs more strongly following the institutional pressures exerted by the strongly binding Paris Agreement. This effect varies due to institutional country-of-origin effects and exposure to host countries with stringent environmental regulations. We provide empirical support using a difference-in-differences analysis of 3193 MNCs from 60 countries with pledged commitments to emission reductions in the Paris Agreement.

International Organization for Standardization (ISO) 14001 has been recognized as pivotal for achieving sustainable development goals. Nevertheless, managers continue to seek financial justifications for adopting this prominent global standard. Our study shows that ISO 14001 increases the market value of multinational corporations (MNCs) more strongly following the binding Paris Agreement, as the global standard reassures investors about corporate alignment with global climate goals. Although the financial impact of ISO 14001 appears to be greater for MNCs from emerging economies, owing to the lower expectations associated with institutional quality in emerging economies, investors correct the (economic) evaluation of ISO-certified MNCs according to their exposure to host countries with stringent environmental regulations. These findings inform managers of the importance of aligning corporate sustainability with geographical diversification strategies.